Red Lobster's Creditors Balk At Bankruptcy Settlement Proposal

The drawn-out Red Lobster saga takes center stage once again in restaurant dramatics, this time with a united chorus of creditors pushing back on a proposed bankruptcy settlement. The gripping claws of the generally well-loved dining chain, with 700 worldwide locations prior to recent closures, have maneuvered intricate survival attempts involving dissatisfied debt holders, failing revenue, ownership changes, employee layoff lawsuits, insolvency, and a Chapter 11 bankruptcy filing in early May 2024. But the offered resolution is far from a relief, at least for those left holding the proverbially empty lobster pot.

At its core, the current outcry stems from the fact that Red Lobster's proposition reportedly fails to compensate numerous unpaid creditors, some being stiffed for six-figure bills. The debts involve a wide net of uncompensated service providers and landlords of Red Lobster restaurant spaces. Under the proposed bankruptcy terms, the chain would be sold to new owners, specifically its largest aggregated creditor under the banner of Fortress Credit Corp., which would take ownership of the absorbed debt.

However, individual creditors are demanding payment of their existing bills as well as guarantees moving forward that store performances will be satisfactory. These debt holders are largely independent providers, but also include seafood supplier and majority owner Thai Union Group, which previously announced plans to sell its Red Lobster stake.

Suppliers and distributors caught in a cross net

In addition to landlords, other creditors balking at the Red Lobster bankruptcy settlement include day-to-day providers for operational necessities such of cold storage, payment systems, and equipment and repair providers. Many are continuing to provide services and honor leases, leading to accumulating debt and mounting unpaid bills as the bankruptcy settlement, objections, and potential buyout plays out.

Seafood suppliers and food distributors are particularly vulnerable to ongoing financial burdens, collectively owed millions of dollars in arrears, according to SeafoodSource. Pacific Seafood in Oregon already filed a claim in U.S. Bankruptcy Court in Florida, with up to a dozen seafood suppliers potentially, or at least eligibly, poised to do the same. Performance Food Group and a related subsidiary reportedly hold Red Lobster debt totaling an estimated $24.4 million.

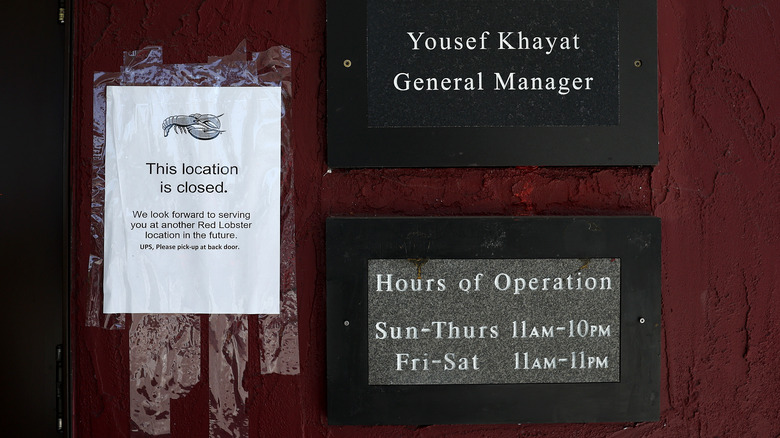

Store closures are likely to continue as the process unfolds. In addition to the 100 shuttered stores earlier this year, at least that many, and possibly more, are at risk of closure due to failures in lease negotiations. That includes one of Red Lobster's prime locations at 5 Times Square in New York City. The New York Post reports that the lease owner of the prominently placed building is significantly altering the terms of the lease, increasing the annual rent from $1 million to $2.2 million.